Ports Shipping and Inland Waterways

Objective

Double the share of freight transported by coastal shipping and inland waterways from 6 per cent in 2016-17 to 12 per cent by 2025.

Increase the port handling capacity to 2,500 million metric tonnes (MMT) by 2022-23.

Reduce the turnaround time at major ports from about 3.44 days (2016-17) to 1-2 days (global average) by 2022-23.

Increase the throughput of inland waterways from 55.20 MMT in 2016-17 to 60-70 MMT by 2022-23.

Augment the capacity of inland water transport by increasing the least available depth.

Current Situation

1. Ports and shipping

The Ports and Sagarmala - Key for Trade

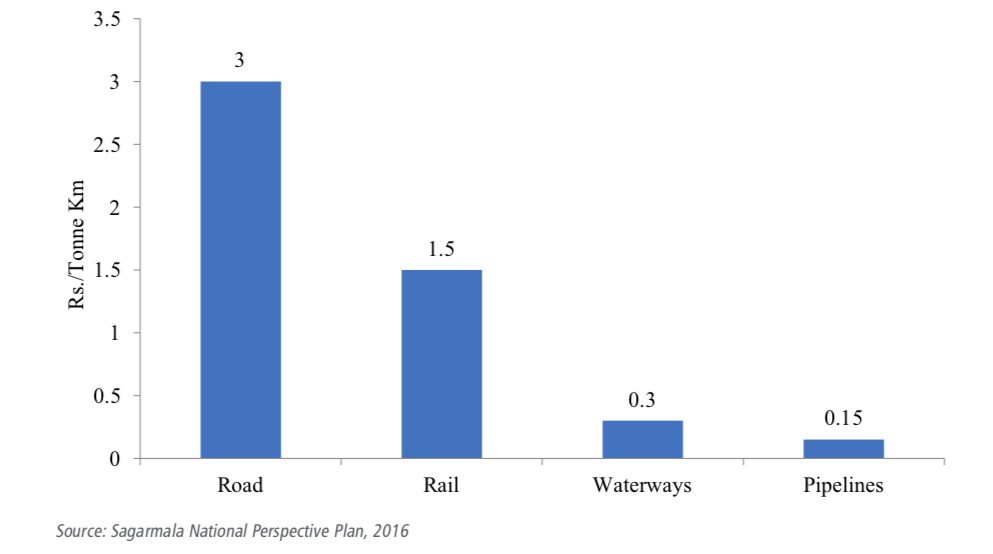

India has a coastline spanning about 7,500 km, forming one of the biggest peninsulas in the world. Around 90 per cent of India’s external trade by volume and 70 per cent by value are handled by ports. Twelve major ports and 205 non-major ports operate on India’s coast. Yet, roads and railways continue to be the dominant mode for cargo movement. Despite being the most cost-effective (Figure 16.1) and efficient mode, water transport accounted for 6 per cent of freight transport in India in 2016-17.

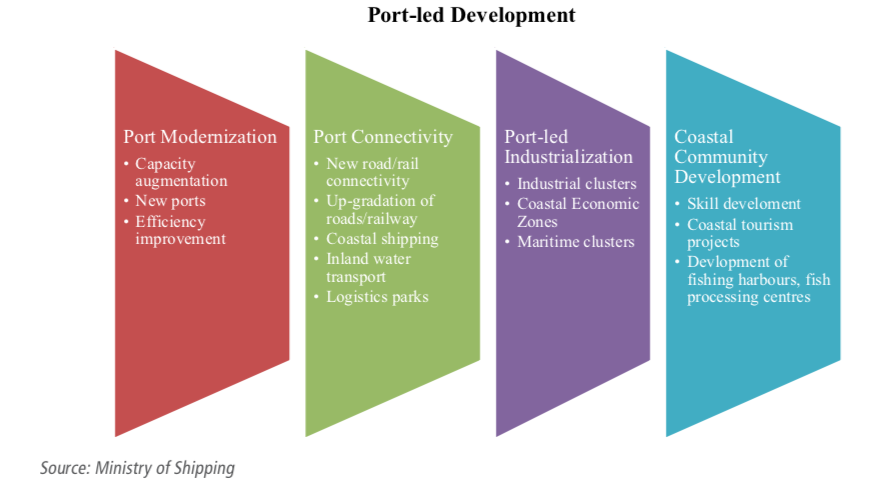

The total cargo handling capacity at major and non- major ports stands at 2161.85 MMT as on March 3l, 2017. Total capacity utilization across all ports was 52.44 per cent. During 2016-17, the total cargo throughput through major and non-major ports was 1133.69 MMT. The Ministry of Shipping’s Sagarmala programme focuses on modernizing and developing ports, enhancing port connectivity, supporting coastal communities and stimulating port-linked industrialization (Figure 16.2). Sagarmala aims to reduce the logistics costs for foreign and domestic trade, leading to an overall cost savings of INR 35,000 to INR 40,000 crore annually by 2025. It also aims to double the share of water transportation in the modal mix.

The government has set up the Sagarmala Development Company Limited (SDCL) to provide funding support to special purpose vehicles (SPVs) set up to implement projects and the Indian Port Rail Corporation Limited (IPRCL) to undertake port- rail connectivity projects under Sagarmala.

Figure 16.1: Operating cost comparison in transporting cargo through various modes

Note: Image taken from Niti Aayog - Strategy for New India@75 Document

Note: Image taken from Niti Aayog - Strategy for New India@75 Document

Figure 16.2: Pillars of the Sagarmala programme

Note: Image taken from Niti Aayog - Strategy for New India@75 Document

Note: Image taken from Niti Aayog - Strategy for New India@75 Document

2. Inland waterways

Inland Water Transport (IWT)

Inland Water Transport (IWT) carries less than 2 per cent of India’s organized freight traffic and negligible passenger traffic. The annual freight volumes carried on inland waterways using National Waterways (NW-1, NW-2, and NW-3) and Goa Waterways was 21.91 MMT in 2016- 17. Additionally, Maharashtra Waterways alone transported more than 33.29 MMT.

The Inland Waterways Authority of India (IWAI) is mandated to develop and maintain infrastructure for fairway, navigational aids and terminals. The IWAI also provides an enabling environment for private investment in cargo vessels and operational services. Until 2015, there were only five NWs in the country. In April 2016, 106 more waterways spread over 24 states were declared as NWs. The ministry is augmenting the capacity of NW-l under the Jal Marg Vikas project. The project will enable the movement of larger vessels of 1,500-2,000 tonnes on inland waterways. The government is also proposing to fund NWs through the Central Road Fund (CRF). The Ministry of Finance has amended the Central Road Fund Act, 2000, as part of the Finance Bill 2018 to include a list of projects and infrastructure sub-sectors, including inland waterways, for which the CRF could be used. The CRF has since been renamed the Central Road and Infrastructure Fund

Constraints

1. Model Mix

Roads (54 per cent) continue to be the dominant mode of transporting cargo, followed by rail (33 per cent). Transportation of cargo through waterways – shipping and inland water – accounts for a minuscule modal share (6 per cent) despite it being the most cost - effective and efficient mode.

2. Draught levels:

Most Indian container handling ports lack the capability to handle large container vessels due to inadequate depth; a minimum draft depth of 18 metres is needed to enable mother vessels to dock at ports. With international trade leaning towards the more economically viable mother vessels, shallow draft adversely affects a port’s potential to become a hub port.

3. Connectivity to ports:

Weak hinterland connectivity between production centres and gateway ports often leads to higher costs and delays because of sub-optimal mode choices.

4. Transhipment port:

A large percentage of containers in India are currently transhipped through other ports, such as Colombo (just south of India), Singapore (East), Dubai and Salalah (West) due to the absence of a transhipment port in the country. This has led to additional costs and delays due to the feeder voyage from India to the hub port.

5. Charges by the shipping lines:

The business practices of shipping lines have played a key role in the present negative perception of sea transport. A long pending concern has been the high rate and multiplicity of charges imposed by shipping lines.

6. Capital for inland vessels:

At present, the cost of capital is very high and makes IWT freight uncompetitive. It is difficult to attract capital for building inland vessels as it is a significant investment.

7. Technical issues in inland waterways:

The varying and limited depths due to the meandering and braiding of alluvial rivers and the erosion of their banks causing excessive siltation, lack of cargo earmarked for IWT, non-mechanized navigation lock systems and insufficient unloading facility at terminals hinder the use of IWT by shippers.

8. Regulatory issues for inland waterways:

States’ Ferries Acts from various years govern cross ferry movement and this may present a barrier to inland navigation, as the regulations may not take into account safety considerations.

Way Forward

1. Open up India’s dredging market

Dredging Market

The government needs to open up the dredging market to attract more players, particularly international players, in dredging activities to increase and maintain draft depth at ports to attract large vessels and enable them to become hub ports. At present, the Dredging Corporation of India (DCI) and a limited set of private vendors serve the Indian dredging market, limiting competition. Foreign players will be attracted to the market if the government takes measures such as consolidating dredging contracts across cohorts of ports and withdrawing, at least temporarily, the right to first refusal given to Indian vendors.

To enable major ports to handle larger vessels, an action plan to increase the draft depth of ports has been prepared. Most major ports have already achieved a draft of 14 metres or more except Kolkata Port, where deeper draft has not been feasible because of the riverine nature of the port. Some major ports are striving to achieve deeper drafts up to 18 metres. The outer harbour in Visakhapatnam has very deep draft of more than 18 metres. Work is in progress to create a draft of more than 18 metres in Mormugao and Kamarajar Port.

2. Expedite the implementation of Sagarmala

Projects under Sagarmala

Expedite the completion of various projects under Sagarmala, especially those aimed at improving port connectivity, setting up coastal economic zones (CEZs) and establishing new ports.

The setting up of a single window facility for cargo clearance and putting in place fully mechanized cargo handling infrastructure will be critical to increase throughput.

3. Ease the business environment around shipping and ports

Free on Board

The Government of India needs to take a fresh look at its policy of imports on a "Free on Board” basis (FoB policy) as it needs to balance risk between the importer and exporter.

Enhance technology use in ports and, wherever feasible, draw lessons from successful global ports such as Rotterdam, Felixstowe and Singapore to improve efficiency.

4. Transhipment ports and shipping lines

Transhipment via Cochin

Transhipment via Cochin ICCT (already commissioned), the upcoming Vizhinjam Port and the Enayam Port at Colachel will create a transhipment cluster similar to the clusters in Malaysian and Singaporean ports. The cluster should be completed within the targeted timelines and a business plan should be drawn up to make it a success.

The new Merchant Shipping Bill to replace the Merchant Shipping Act, 1958, needs to be enacted at the earliest to promote the ease of doing business, transparency and effective delivery of services. Opening up of the sector will improve the availability of ships and help reduce costs.

5. Enhance last mile connectivity to inland waterways

Enhance Linkages between National Waterways

IWT should be integrated to multimodal/ intermodal connectivity. Inland terminals with proper road and/or rail connectivity and seamless transfer of goods from one mode to the other are important for an efficient logistics supply chain.

Procure floating terminals and cranes and place them suitably so that access to roads is possible.

Enhance linkages between national waterways and state waterways and feeder canals.

6. Facilitate access to capital for inland vessels

Waiving Waterway Charges

Financing for inland vessels could be made part of priority sector lending by banks.

Categorizing inland vessels as infrastructure equipment will further ease access to capital issues for a sector where capital investments and operational costs are high.

Initially, viability gap funding needs to be given at least for 10 years until the infrastructure is fully developed, so that inland water transport is competitive.

We should consider waiving waterway charges and lock charges until operable infrastructure is made available.

Revive the shipbuilding finance scheme in line with the subsidy scheme that was in force during 2002-2007, which led to high growth rates in the shipping sector and full order books for Indian shipyards.

7. Address technical and regulatory constraints in inland waterways to ease movement of inland vessels

Jal Marg Vikas project (JMVP)

CCEA, chaired by the Hon’ble Prime Minister approved the implementation of the Jal Marg Vikas project (JMVP) to augment the capacity of National Waterway-1 (NW-1) with technical assistance and investment support from the World Bank at a cost of INR 5369.18 crore. We must ensure that the project is completed by March 2023.6

From a regulatory standpoint, detention of a vessel without a valid reason should not be allowed.

A clear directive needs to be issued for security of inland vessels, crew and cargo.

Strengthen existing Inland Water Transport Directorates or Maritime Boards or set them up in states where they do not exist to ease the IWT business and to ensure efficient regulation and facilitation of IWT for cargo movement.